Commercial Storm Insurance and Hurricane Coverage

9/3/2020 (Permalink)

Commercial Storm Insurance and Hurricane Coverage

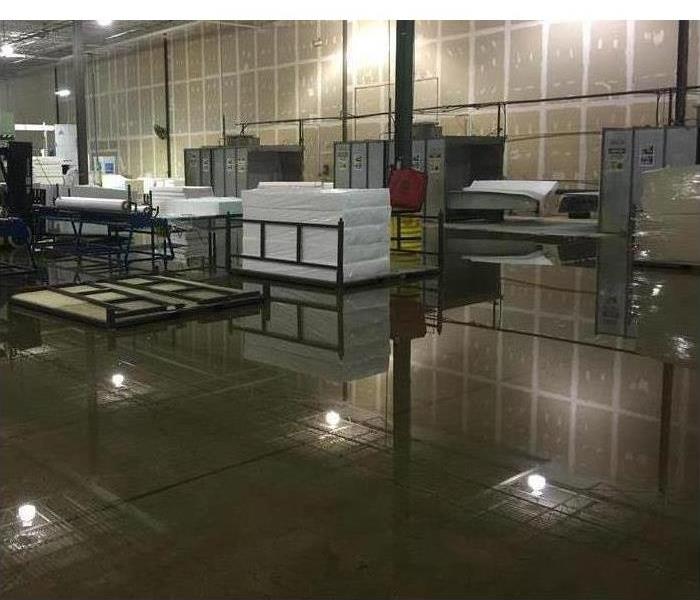

When you think about storm insurance, coverage for rain, and ice damage to your building comes to mind. Yet these are not the only losses that your insurance covers. Your insurer may also help you pay for harm caused by hurricanes or heavy winds.

Hurricane Coverage

The last few decades have seen several major windstorms hit the United States, from Hurricane Andrew in 1992 to Hurricane Katrina in 2005. States near the Atlantic Ocean are particularly prone to hurricanes during the months between June and November. As a result, insurers in Washington, D.C. and the below states now offer hurricane deductibles:

- Alabama

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Louisiana

- Maine

- Maryland

- Massachusetts

- Mississippi

- New Jersey

- New York

- North Carolina

- Pennsylvania

- Rhode Island

- South Carolina

- Texas

- Virginia

Hurricane Deductibles

If your business is located in one of the above-mentioned states, your policy likely includes some form of wind or hurricane insurance coverage. This storm insurance can help you pay for restoration and cleanup services following a disaster.

However, hurricane coverage includes a deductible. This is the amount that you as the property owner will have to pay before the insurance is applied.

Keep in mind that the event triggering the deductible varies in each state. For instance, in Connecticut the deductible is triggered whenever the National Weather Service indicates a hurricane with winds of at least 74 miles per hour. However, in Maryland, the deductible is applied whenever any part of the state comes under a hurricane warning.

In most states, the insurer determines the amount of the deductible. Check your policy or contact your insurance representative in Gilberts, IL, for more information.

Commercial storm insurance does not just cover rain, snow, and hail. If you live in certain parts of the country, you should have hurricane coverage, as well. While you will still have to pay a deductible, your insurance should greatly reduce the disaster's financial cost to your business.

24/7 Emergency Service

24/7 Emergency Service